Why owning shares in rare earth miners is so high risk

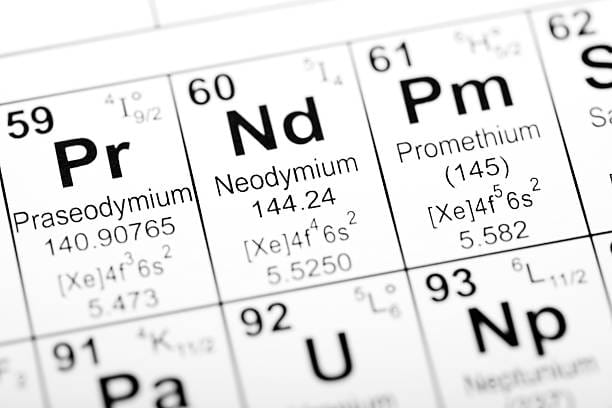

The growing tensions between China and the United States has focused attention on several issues, including the importance of rare earths in future technology such as mobile phones and batteries through to sophisticated military hardware.

Just the very name suggests that investing in rare earths is a sure-fire way of making money and it is certain that there is only a finite amount of so-called rare earths on the planet to be mined and the apparent demand for them will only grow.

The problem with so many sure-fire ways of making money is that most are not.

The big issue around rare earths is that China controls a large number of mines and has used its economic clout to effectively flood the world markets for these earths, which has caused prices to collapse.

This has caused the development of rare earth mines to slow, if not stop around the world as it is impossible to make the sums add up to develop mines at current prices for most rare earths.

This is the case with Lithium for example which was touted in a similar way a few years ago as being a sure fire way to make money. That hasn’t happened with the price of lithium languishing and costs of developing mines and processing plants skyrocketing.

Rare earths have suddenly come to the fore because the United States has decided to embark on a trade war with China and then suddenly realized that their supply of rare earths, which they need for key military applications, might stop.

It’s hard to see the United State continuing down the track of stopping all imports from China as this one step will lead to the loss of millions of jobs amongst transport workers and retail staff, so hopefully sense will prevail.

Lynas Rare Earths for example was able to take advantage of a similar spate between China and Japan some ten years ago when a trade war erupted between them and China stopped supplying Japan with rare earths. Lynas was able to step in and fill the breech and that’s how it survived to this day.

However, it hasn’t done much to improve the fortunes of shareholders in Lynas or any other rare earth miners in Australia. Most have enjoyed a small spike in their share price as the media suddenly run stories about rare earths.

However, none are posting dividends which puts a question market as to how profitable these companies are now or will be in the future.

There is nothing to say China won’t persist in flooding the world with cheap rare earths. However, it does little to suggest that rare earth mines in Australia will suddenly become a boom industry and post the sort of returns many Australians are hoping for.