Know what you’re investing in

There aren’t many financial services businesses that have got on my goat in recent years the way La Trobe Financials has regarding their advertisements and now I see that ASIC has finally turned their attention on this company.

Not that I believe there is anything intrinsically wrong with La Trobe Financial. If you have money invested with them, I don’t think you have anything to be concerned about, they are a well-managed company that has been around a long time.

As far as I know, no one has lost any funds that they have invested with them. My long-standing concern with them is that while that don’t mislead investors exactly, they come very close to it.

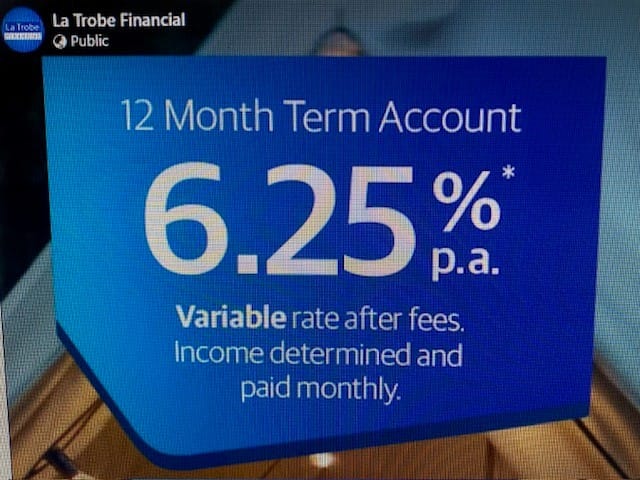

For years they have run national advertising campaigns promoting ‘term accounts’ and their higher than average ‘rate of interest’ and doing everything they can to suggest these products are as ultra-safe as a term deposit with one of the big banks.

Their products though, are nothing like term deposits and this is where they have really annoyed me as over the years, many clients have asked, “Why aren’t I investing in high yield term deposits with La Trobe Financials?”

La Trobe is basically a sub-prime lender. It raises funds from the public and then on-lends these funds primarily to property developers, who have been turned away by the big banks.

From what I have read and know about La Trobe they have managed the risk involved with this type of lending extremely well and as they are now a $2 billion company, they have done so in a very profitable way.

However, my problem with them is that as soon as I tell people the truth, that La Trobe Financial are not offering better returns but higher returns because they are on-lending to a high-risk part of the property development industry, they shy away.

It’s this lack of disclosure that has always annoyed me and now these ads are quite rightly, and clearly, annoying ASIC and changes will be made to how La Trobe and others like them can and do advertise their investment products.

Common sense is everything. No one can offer a true-term deposit unless they are a bank and if the rate of interest is significantly higher than that being offered by the banks then clearly it is not a term-deposit.

To think otherwise is just nonsense. While I think ASIC should act to clarify the situation, there is also a role here for everyday people to use some common sense when looking at these types of investments and ask some simple questions before they invest.