Change in minimum pension settings

During the pandemic, the Federal Government was concerned what impact the pandemic related closures would have on the financial markets and with that, how it might impact on Australians’ retirement savings.

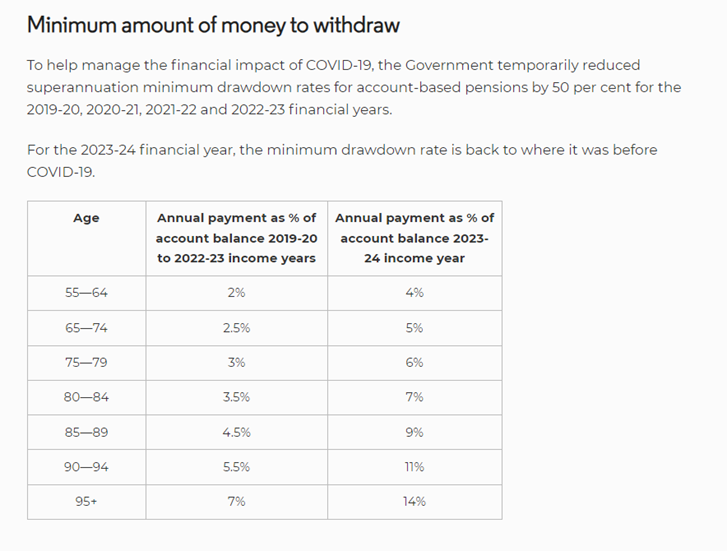

In response, the Government felt it was reasonable to expect investment returns would be lower than in previous years, and that it would be prudent to reduce how much Australians were drawing down from their superannuation savings.

There was also a fear among many in retirement that if they were forced to continue taking the then legislated minimum pension payments from their super accounts, they would irrevocably erode some of the capital in their superannuation accounts.

So, the Federal Government moved to effectively halved the minimum amount Australians receiving a pension from their super accounts could receive. Recipients could elect to continue receiving the old minimum amount, but it did mean Australians had the choice in reducing their payments.

As most retirees receiving the minimum payment have this set as their default choice regarding their superannuation, these changes happened seamlessly without them being required to do anything.

Now that the pandemic has by and large passed, and the financial markets are returning to normal, the Federal Government has decided that it is appropriate to lift the minimum pension rates back to where they were pre-pandemic.

Again, for those who have the minimum payment as the default setting on their pension accounts, these changes will occur seamlessly and for many, it has created a pleasant surprise when they received double their usual payment last month.