Every extra dollar counts

Something that isn’t talked about much these days and should be, is the Federal Government’s Superannuation Co-Contribution Scheme for low-income earners. I think it’s one of the best Government schemes available.

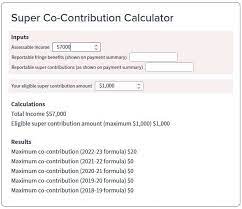

If you earn less than $42,016 a year, for every dollar of after-tax dollars or non-concessional contributions that you make to your super account, the Federal Government will match by adding 50 cents.

So if you contribute say $1000 to super, or just $20 a week, from your after tax income, then the Federal Government will match it by paying $500 into your super account. The best part about this scheme is that you don’t have to do anything more than make the initial contribution.

Once you file your tax return for the financial year, if your income is below $42,016 and you have made extra contributions of up to $1,000, the government’s co-contribution amount will be paid automatically into your super account.

Like all Government schemes there are a few rules. You must be a bona fide employee, you have to be under 71 years of age, have less than $1.7 million in super and have not put in more than $110,000 in non-concessional super during the relevant financial year.

So basically, you have to be just a regular low-income earner.

Just think about it for a moment. Are there a few things in the shed you don’t use any more? You can effectively sell them on Facebook and put those funds into super and get an instant 50 per cent return on your money. Now that’s a good investment.

Of course, while I’m writing about how to boost super contributions for low-income earners and minimize tax, I should also mention spousal contributions. While not as easy as the co-contributions scheme, it can help.

If you are a partner in a relationship, either as a spouse or de facto, and earning less than $37,000 in this financial year, your partner can contribute $3,000 into your super fund and obtain a tax offset of $540 dollars against their tax bill.

Again, some rules apply. You must not be age 75 or older, your super balance must be less than $1.7 million and you can’t have contributed more than $110,000 in concessional contributions through the year.

So not as good as the co-contribution scheme but it is worth knowing about if you are on a high income and your partner has taken timeout of the workforce to care for a child or family member and so have reduced their income for the year.

Every dollar you put into super now will steadily snowball every year until you do retire and slowly bit by bit, you will boost your super balance. Something you will be very pleased about when you do retire.