Are you thinking of downsizing?

The Federal Government has now passed legislation to reduce the eligible age from which Australians can take advantage of the downsizer super contribution rules from 60 to 55 years of age – the second reduction this calendar year.

In addition, the government will extend the asset test exemption period on the sale proceeds, when income-support recipients sell their principal residence, from 12 months to two years.

It will also change the income test so only the lower deeming rate of 0.25 per cent is applied to principal home sale proceeds when calculating “deemed income” for two years after the transaction.

These changes should help anyone who might be undecided about taking advantage of the downsizer contributions strategy, to embrace it with open arms.

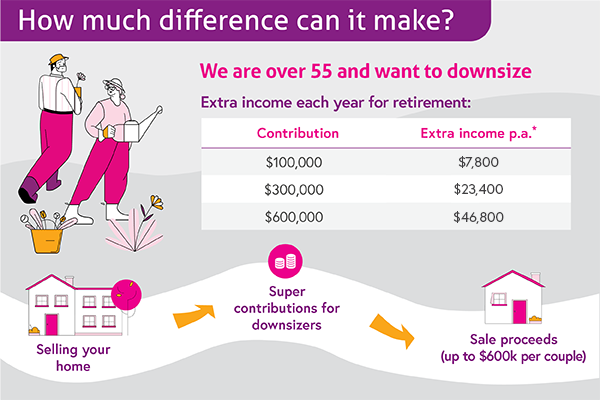

Under these rules, anyone who has owned their family home, which they can sell capital gains tax free and which they have owned for more than 10 years, can use up to $300,000 each from the proceeds of the sale of that home and contribute it to super.

For a couple, this means they can add some $600,000 to their super nest egg without it impacting on their non-concessional super contribution allowance of $110,000 a year each or $330,000 each under the three year bring forward rule.

A couple, who are still under age 75, can now contribute up to $1,260,000 in a single year to boost their superannuation savings. For most Australians, who downsize into a smaller home and have this sort of money left over, this will basically enable them to live financial free in retirement.

It is a great initiative.

Too many Australians stay in family homes that are simply too large for them, too difficult for them to maintain and no longer appropriate for their lifestyle. Hopefully, this initiative will encourage them to review their options.

While it is tempting to postpone any actions due to perceptions of price falls in the current property market, I think anyone in the position to downsize should think again.

Adding an extra $300,000 to super can boost your annual after tax income by potentially $20,000 and if you are part of a couple and contribute some $600,000, it can boost your after tax income by some $40,000 a year.

It’s an opportunity too good to miss out.